closed end fund liquidity risk

Funds are required to assess manage and periodically review their liquidity risk based on specified factors. The fluctuation of the income impacts the funds overall profitability.

But be aware that a funds distribution rate is not the same thing as its returneven if the numbers might look similar.

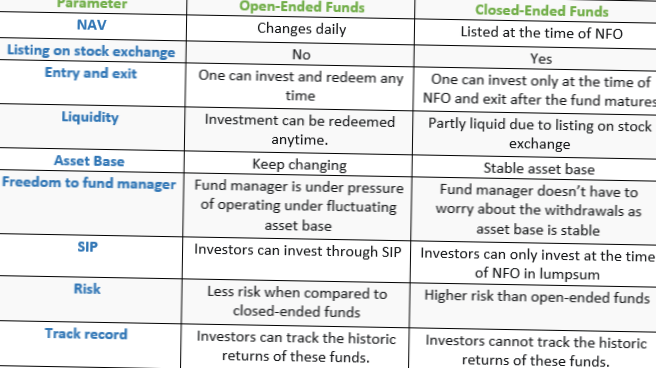

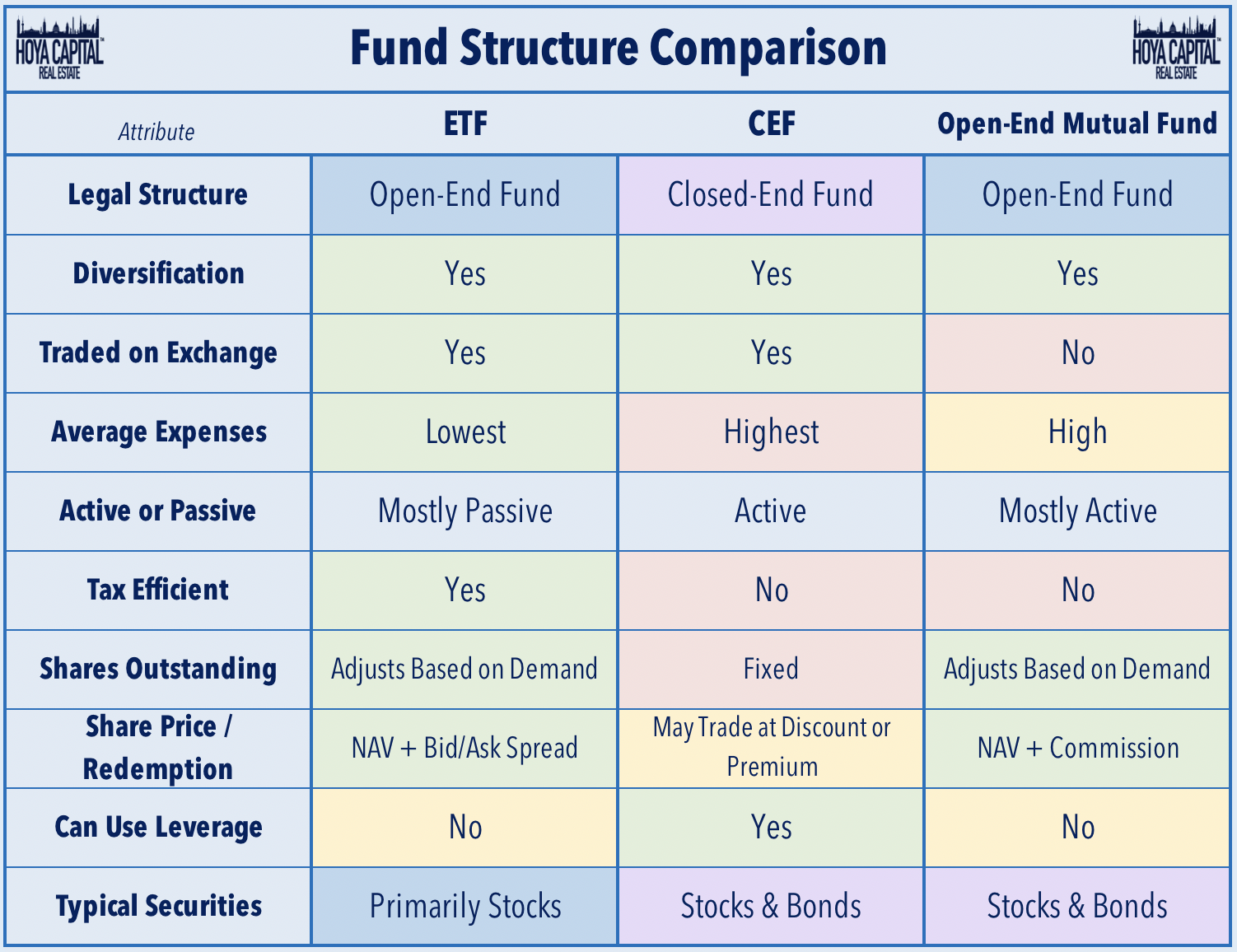

. Liquidity Risks The Fund is a non-diversified closed-end management investment company designed principally for long-term investors and is not intended to be a trading vehicle. Liquidity management and valuation. With open-ended funds the fund company must accept your redemption whenever you want.

Unlisted closed-end funds also provide limited liquidity. A closed-end fund issues shares only once. This also lets them invest in less liquid asset categories and deploy.

In July 2016 the HK SFC published a circular providing additional guidance to asset managers particularly in relation to liquidity risk management. The closed-end funds may invest in securities rated below investment grade and considered to be junk or high. Liquidity risk management program rule1 demand for asset classes that are not suitable for open-end funds which must provide for daily redemption.

If you look at those three big risks in closed end funds. Most risks that apply to mutual funds apply to CEFs depending on the asset classes the fund invests in. Just like open-ended funds closed-end funds are subject to market movements and volatility.

General Private Equity Risks. Funds ETFs but not including money market funds to establish a liquidity risk management program. Investing in the bond market is subject to risks including market interest rate issuer credit inflation risk and liquidity risk.

The only way to get into the fund later is to buy some of those existing shares on the open market. Rule 22e-4 also requires principal underwriters and depositors of unit investment trusts. Their yields range from 632 on average for bond CEFs to.

Just like any other investment product CEFs are exposed to various risks. However CEFs limited redemptions potentially higher leverage and less-liquid investments increase related risks while also enhancing the return potential. 2 hours agoThe Fund is a closed-end fund registered under the Investment Company Act of 1940 as amended with its common shares registered under.

Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. The UK FCA published additional. In October 2016 the US SEC adopted new rules designed to promote effective liquidity risk management for open -end funds.

The market for municipal bonds is generally less liquid than for other securities and therefore the price of municipal bonds may be more volatile and subject to greater price fluctuations than securities with greater liquidity. Closed-end funds have become popular products because some offer high distribution ratesas high as 6 percent or more. Notably closed-end funds make frequent use of.

Funds or funds4 or closed-end upon which several of the Acts other provisions depend. Compared to ETFS closed-end funds have two main advantages when investing in digital assets. If the CEF includes foreign market investments it will be exposed to the typical foreign market risks including currency political and economic risk.

A Funds annual report contains or will contain this and other information about the Fund. And a weak market for traditional closed-end fund initial public offerings. The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF.

The value of a CEF can decrease due to movements in the overall financial markets. And before you invest be sure you understand where the closed-end fund is getting the money to pay distributions. A liquidity risk should be addressed only if a big part of your investment portfolio is not liquid.

The results of the study indicate that closed-end fund discounts increase closed-end fund market prices are lower relative to net asset value as. CLOs are exposed to risks such as credit default liquidity management volatility interest rate and credit risk. Like it or not digital assets such as bitcoin are an increasingly.

Sensitivity To Interest Rates An interest rate may impact the cost of a CEFs debt which it uses to buy securities. Liquidity risk is defined as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors interests in the fund. Closed-end funds meanwhile invest virtually every cent because they arent required to constantly repurchase shares.

The value of most bonds and bond strategies are impacted by changes in interest rates. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk. Investing Previous Post Next Post.

Investing in derivatives entails special risks relating to liquidity leverage and credit that may reduce returns andor increase volatility. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the. Changes in interest rate levels can directly impact income generated by a CEF.

An investor should not invest in the Fund if the investor needs a liquid investment. A word about risk. Closed-end funds CEFs can be one solution with yields averaging 673.

Classification of the Liquidity of Fund Portfolio Investments. When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Investing In Closed End Funds Nuveen

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

Reassessing Investment And Liquidity Risks Kpmg Global

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Closed End Fund Fs Investments

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Understanding Interval Funds Griffin Capital

A Closer Look At Closed End Funds Fundx Insights

Closed End Fund Definition Examples How It Works

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Pdf A Liquidity Based Theory Of Closed End Funds

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer